17 July 2025

Back To School Costs

The Irish League of Credit Unions (ILCU) has published the 2025 results of its annual Back to School survey in both ROI and NI. The surveys track the costs and impacts of children returning to school as well as broader cost-of-living factors.

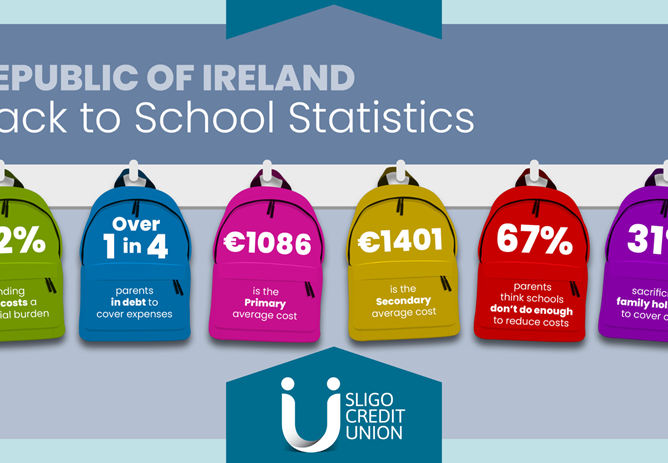

The 2025 research has found that 1 in 3 (33%) parents now say that they get into debt covering back to school costs, and the average amount in 2025 is €376 compared to 1 in 4 parents in 2024, taking on an average of €368 of debt. Over a third (35%) of parents say that they are forced to deny their children at least one back to school item.

The total Back to School spend in 2025 is €1,450 for primary school parents and €1,560 for secondary school parents. This is an increase for primary school parents of €364 compared to 2024, and €159 for secondary school parents.

After school-care is the top expense for primary school at €197, and overall, 3 in 5 (61%) parents believe that schools don’t do enough to help keep the costs of going back to school down. The research also found that 64% believe that back to school costs are a financial burden, a slight increase on 62% in 2024.

Commenting on the 2025 findings, David Malone, CEO, Irish League of Credit Unions said: “This year’s back to school survey findings are reflective of the broader pressures being felt across society associated with the increasing cost of living."

While the fact that 1 in 3 are taking on debt is significant, the research also shows that more and more households are sacrificing to pay for back-to-school, particularly when compared to recent years. Family holidays (37%) are still the biggest sacrifice, up 6% on 2024, with almost 1 in 5 (18%) sacrificing food compared to 13% in 2024.

“This overall trend of increasing costs and the accumulation of debt is further reflected in the 2025 findings concerning the methods of payment used for back to school supplies. General monthly income (74%) remains the top method of payment but has dropped from 80% in 2024. There has been a significant increase in those using savings, 42% in 2025 which is a 7% increase on 2024, and the number of parents taking out credit union loans (12%) has tripled from 4% in 2024.”

In 2025, the Back to School research also looked at the role and impact of free hot meals for school children, with Mr Malone commenting: “The continued roll out of the Governments hot meals scheme features prominently in this year’s research, with more than 3 in 4 (78%) agreeing with the expansion of free hot meals to all primary schools in Ireland. Indeed, it is telling that the top reasons were financially driven, these being a guaranteed lunch for a child and thus reduced food insecurity (66%) and the reduced cost of lunches for parents (56%).

“Overall, with 36% of households now carrying debt of over €500 and an increasing number using their savings to cover back to school costs, the tangible and intangible pressures for households across the country are real. This year’s research also clearly illustrates how parents are having to take a considered approach to costs and be further prepared to sacrifice. Given the findings, it is unsurprising that an increasing number are turning to credit unions as community focused, not-for-profit financial services providers. Our role goes beyond that of the financial, and I would encourage anyone seeking assistance to engage their local credit union who continue to support communities across Ireland.”

The 2025 research also yielded the following insights:

- 78% of schools ask for a ‘voluntary’ contribution.

- After-school care is the top expense for primary schools (€197).

- 64% say that they shop online for supplies, down from 71% in 2024. 59% do so for better deals.

- Almost 2 in 3 (59%) parents feel pressured to buy branded clothing, footwear, and other items for their children, up 6% from 2024.

- In 2025, 35% of parents say they’re forced to deny their children at least one back to school item and 50% state that new gym gear is the number one item they’re forced to deny.